Home Venice 2014 Workshop

Eventdescription

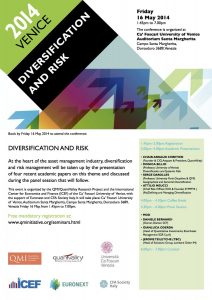

Diversification & Risk

At the heart of the asset management industry, diversification and risk management will be taken up by the presentation of four recent academic papers on this theme and discussed during the panel session that will follow.

This event is organized by the QMI/QuantValley Research Project and the International Center for Economics and Finance (ICEF) of the Ca’ Foscari University of Venice, with the support of Euronext and CFA Society Italy.

CFA Society Italy has determined that this program qualifies for 3,5 CE credit hours under the guidelines of the CFA Institute Continuing Education Program .

Agenda May 16, 2014

1.45pm – 2.00pm: Registration

2.00pm–4.00pm: Academic Presentations

Chair: Arnaud Chretien (Founder & CIO, Aequam & President, QuantValley)

– Monica Billio (University of Venice): Diversification and Systemic Risk Serge Darolles (Université Paris-Dauphine & QMI): The Hidden Risks of Smart Indices Emmanuel Jurczenko (ESCP Europe & QMI): Generalized Risk Based Investing Attilio Meucci (KKR & SYMMYS): (Re)Defining and Managing Diversification

4.00pm – 4.30pm: Coffee Break

4.30pm – 5.15pm: Keynote Speech

Robert Fernholz (Founder and Chairman of the Investment Committee, INTECH)Diversification, Volatility and “Surprising Alpha”

5.15pm – 6.30pm: Panel Session

Moderator: Christian Gouriéroux (CREST, University of Toronto & QMI)

– Daniele Bernardi (Owner, Diaman SCF)Yves Choueifaty (CEO, TOBAM)Gianluca Oderda (Head of Quantitative Investments, Ersel Asset Management SGR S.p.A.)Vassilios Papathanakos (Deputy Chief Investment Officer, INTECH)

6.30pm – 7.30pm: Cocktail

Venue Ca’ Foscari University of Venice, Auditorium Santa Margherita, Campo Santa Margherita, Dorsoduro 3689, Venezia

Previous events

The 18th International Conference on Computational and Financial Econometrics (CFE 2024) Conference

The 18th International Joint Conference on Computational and Financial Econometrics (CFE) and Computational and Methodological Statistics (CMStatistics), CFE-CMStatistics 2024, will be hosted by King’s College London, 14-16 December 2024.

Read more

14th Annual Hedge Fund Research Conference Conference

The Annual Hedge Fund Research Conference is a two-day academic conference with sessions that did cover the latest research on asset management, and more particularly on institutional investors’ risks and performance; transparency (reporting) and due diligence; financial intermediation activity; hedge fund and broad macroeconomic issues such as systemic risk and contagion; institutional investors’ incentives and...

Read more

The 17th International Conference on Computational and Financial Econometrics (CFE 2023) Conference

The 17th International Conference on Computational and Financial Econometrics (CFE 2023) will be be hosted by HTW Berlin, University of Applied Sciences (Wilhelminenhof campus), Berlin, Germany, 16-18 December 2023. The joint conference CFE-CMStatistics will have five Plenary Sessions. Moreover, CFE 2023 had four Special Invited Sessions, a significant number of Organized Invited Sessions on key topics, Contributed, and Poster Sessions that...

Read more

The 16th International Conference on Computational and Financial Econometrics (CFE 2022) Conference

The 16th International Conference on Computational and Financial Econometrics (CFE 2022) will be hosted by King’s College London, 17-19 December 2022. The joint conference CFE-CMStatistics will have five Plenary Sessions. Moreover, CFE 2022 will have four Special Invited Sessions, a significant number of Organized Invited Sessions on key topics, Contributed, and Poster Sessions that will run in parallel during the three...

Read more

Intelligence Artificielle & Machine Learning – 4th Edition Hackathon

Dès l’après-midi du vendredi 11 mars, travaillez pendant 24h avec étudiants, jeunes diplômés, chercheurs et ingénieurs de l’Université Paris-Dauphine PSL, ENSAE, LFIS et SESAMm pour explorer les domaines de l’intelligence artificielle et du machine learning dans l’industrie de la gestion d’actifs. L’évènement est gratuit mais l’inscription avant le 25 février est obligatoire et se fait...

Read more

The 15th International Conference on Computational and Financial Econometrics (CFE 2021) Conference

The joint conference CFE-CMStatistics will have five Plenary Sessions. Moreover, CFE 2021 will have five Special Invited Sessions, a significant number of Organized Invited Sessions on key topics, Contributed, Virtual and Poster Sessions that will run in parallel during the three days of the conference.

Read more

Forecasting Portfolio Weights, by Hughes Langlois Webinar

A portfolio manager’s two primary objectives are to: (i) achieve an optimal long-term allocation across strategies and / or assets, and (ii) appropriately rebalance the portfolio over time, i.e. in the short-term. This article considers the weaknesses of classical approaches to these challenges and proposes an innovative short-term allocation approach designed to achieve the portfolio’s long-term...